Tesla the madness of cars

$2,000 a share was an important milestone for Tesla, at that price it was valued at $372bn. This seems like a big number and we are reminded of Senator Dirksen’s famous quote “A billion here, a billion there, and pretty soon you’re talking real money.“

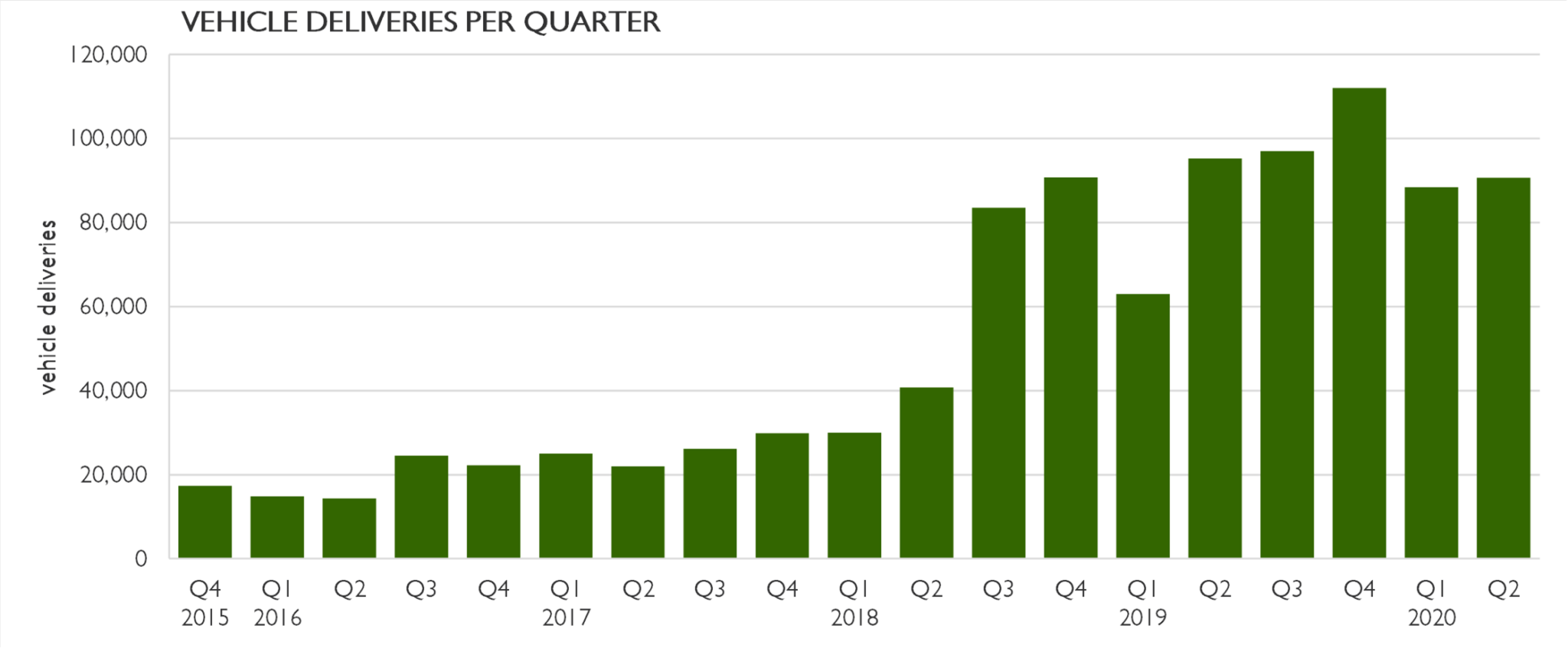

Another way of looking at that valuation is that it is $1m for every car it sells in a year. Just think about that for a moment. It is objectively nonsense. It is nonsense in so many ways it does not need deep exploration, but just to provide some comparisons: over the last two years Tesla has shipped around 360,000 cars a year; Toyota ships around 9,000,000 a year. Tesla’s debt is rated as “junk”, Toyota’s debt is rated as “A+” yet Toyota is worth less than half of Tesla.

The profit margin in highly competitive markets is not high. A double digit profit margin is achieved only in exceptional years by exceptional car manufacturers. The Tesla 3 sells for $35,000. Let’s say they make a 10% margin (which it does not – it is fundamentally loss making at this price but that’s another subject), heck let’s be generous and say they make a 15% margin. That’s $5,250 of profit per car yet the stock market is saying Tesla should be valued at $1m for each car produced.

If anyone wishes to value businesses in this manner please raise your hand and come this way, we have lots of business to discuss.

So is Tesla going to grow into this valuation? Does its rate of growth and prospects justify the valuation? The answer is “no, unequivocally no”. Even if you assume Tesla can make higher margins than Toyota because of a higher software component, then it will still have to make around 10m cars to justify that share price.

You’ll note that Tesla has had a good lockdown (in comparison to other motor manufacturers) but the rate of progression over the last two years suggests that 10m cars a year is many many years away on the current trajectory.

Also Tesla isn’t selling software, it is selling physical products that require factories, supply chains and distribution to produce – even assuming the demand is there for 10m Tesla’s in a shrinking car market. This will require a massive scaling of capacity for Tesla to meet these volume targets and building car plants takes time and huge amounts of capital expenditure. Less than two years ago there were doubts raised about Tesla’s ability to service its current debt pile. Now the share price assumes that its balance sheet can absorb the CAPEX required to build the largest capacity car manufacturing the world has ever seen and that it can flawlessly execute this strategy.

We should also mention that it will have to develop scale manufacturing skills that it currently does not possess. The way that Tesla model 3’s are made is closer to a talented hobbyist than a volume manufacturer. American cars are infamous for less precise bodywork than European or Japanese car manufacturers but the panel gaps and rattles that engineers found when deconstructing the Tesla 3 are what we’d expect from a small volume manufacturer – a Lotus or a TVR – not a Toyota or a VW.

An article describing the deconstruction and analysis is here:

https://www.motortrend.com/news/tesla-model-3-teardown-deconstructed-3/

We think some credit should be given to Tesla in this regard though, it may be a bit amateurish but the scale of accomplishment in getting to where it is today is prodigious. It is a fair challenge to note that this rapid pace of development is not currently profitable and never has been, but it has gone from zero to where it stands today and its rate of expertise accumulation is extremely rapid.

But this note is about the share price rather than the car.

Tesla’s share price is immediately reminiscent of a bubble, more specifically the dotcom bubble. The logic behind buying the shares echoes it too – the internet is awash with speculators discussing the paradigm change that Tesla will bring with autonomous cars and continuous upgrades. Similarly in the late 1990’s revenues and profits were deemed irrelevant and even unnecessary for companies as long as they were doing “the internet”.

For those who are interested in the history of investing there have been many bubbles in the past, from Tulip mania in Holland to the Mississippi Company in France and the more recent housing bubble that culminated in the financial crisis in the US. The first book on the subject was “Extraordinary Popular Delusions and the Madness of Crowds” by Charles Mackay. This was published in 1841, but the author would know precisely what we are looking at when we look at Tesla.

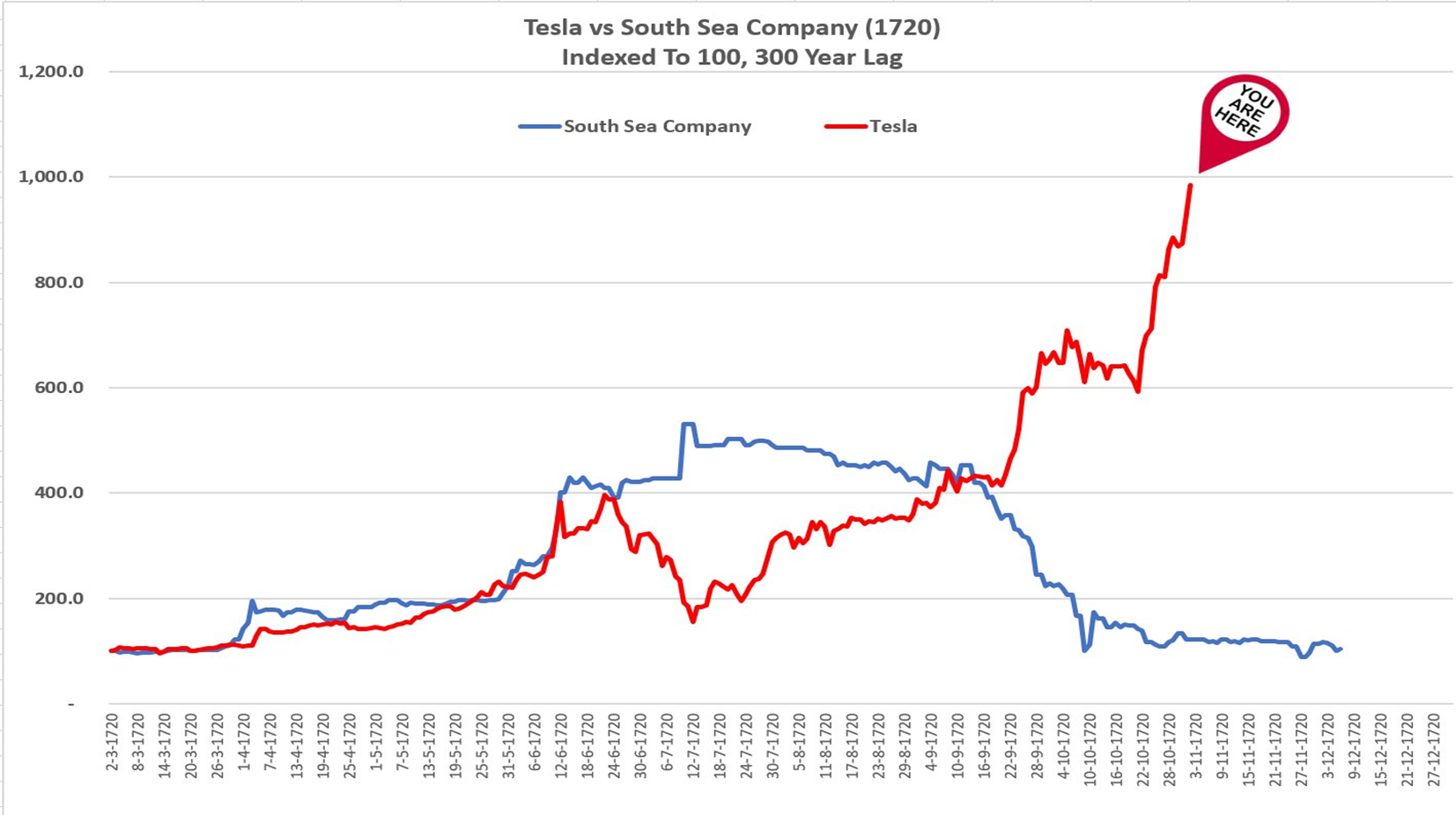

To provide a comparator to Tesla, a twitter writer (@Keubiko) has created a graph (below) showing the performance of Tesla stock next to that of another famous speculative frenzy: the South Sea bubble.

[note: The fascinating story of it is outlined here: https://en.wikipedia.org/wiki/South_Sea_Company.]

Isaac Newton, who was himself a victim of the South Sea bubble as an investor famously remarked that he “could calculate the motions of the heavenly bodies, but not the madness of people” .

So why has this frenzy taken hold of Tesla? There are many factors but we would highlight:

The man

Elon Musk is charismatic and unconventional. He is a successful innovator and brings a touch of Elvis-dust to business, from involvement with Paypal to founding SpaceX (a company developing space rocket systems). People like and admire his outsider status and success. He’s dated models and actresses and is married to a musician. He tried to name their child “X Æ A-12” (we are not making this up). He’s Marvel’s Iron Man without the metal suit. He is a headline seeking juggernaut.

The company

Tesla is a great company making innovative products and not just challenging conventions but proving that its alternative vision can be made real. It is easy to project almost impossible future achievements onto a company that has this track record.

Strategic Uncertainty

The future of transportation is uncertain. At some point in the future we will likely be transported in autonomous vehicles that do not use fossil fuels. It may be Tesla and lithium ion batteries that lead the way, it may be Toyota and hydrogen fuel cells, it may be entirely different, but the technology we have suggests that this destination is real and indeed likely. Under some scenarios (Tesla becoming a global dominant transportation solution in a monopolistic way, that it’s technology will be dominant for decades and that no competitor could replicate or sustain a threat etc.) Tesla will indeed be a hugely valuable company. The market is saying that this highly improbable outcome is almost certain.

Men in tights

Robinhood is a trading app that has gained huge traction in the US. It is not substantially different from eTrade, Charles Schwab etc. in that it allows you to buy and sell shares.

Its major innovation is that it is free to use. As with most “free” things, it isn’t really. When you buy and sell shares there is a difference between the price you can sell a share for and the price you pay for it. This is known as the “spread” and it is a compensation for the market makers who provide that liquidity. Liquidity in this context means that they will (at a time of your choosing) buy your shares should you wish to sell them and will sell you shares should you wish to buy them. Let’s say the spread on a company’s shares is 152p – 156p. There is a 4p or 2.6% spread which is the profit the market maker makes when buying from one person and selling to another. What Robinhood cleverly does is it sells that trade to the market makers. If E-trade or TD Waterhouse or Fidelity want to earn that spread then they have to pay a proportion to Robinhood to get it. The consequence is that spreads are wider because the market maker’s will protect their margins, hence the “free” (as always) is a misnomer.

The growing popularity of the app has encouraged a huge number of people who have never invested before to do so.

Vegas

The US is in various states of lockdown, as we all have been. In the US households have been reducing expenditure, paying off credit card bills and cutting back on gambling. They have also been given $1,200 chunks of money from the government. People have cash in their digital pockets, they are bored and this Tesla game looks fun, the way trips to Vegas are fun (for those that like that sort of thing).

The madness of crowds

A free trading app, Tesla being the most discussed company and stock on Twitter, and tik-toks from “experts” explaining why they have gone all-in on Tesla is a potent combination.

[For readers without teenage children “tik-tok” is a social media platform where short videos are shared. It is just over four years old and is now used by nearly 1 billion people. Truly we live in dark times.]

It is hard to avoid Tesla on social media. It has become the prism through which many people look at financial markets. People spend their days discussing this stock alone – it has what is sometimes described as “mind-share”. It is by far the most traded stock on Robinhood. It is by far the widest held stock on Robinhood. It is by far the largest holding of most Robinhood traders. These are obvious hallmarks of a frenzy.

Splitters

On August 11th Tesla announced it would undertake a stock split, whereby for every share you own you would receive four additional shares. The purpose of this is to make the shares more marketable. In simple terms if the share price is $2,000 per share then the investor with only $1,500 can not buy a share. If you issue more shares you reduce the price of the shares – if a company was worth £100 and there are 10 shares in issue then its shares are worth £10 each. If the same company has 100 shares then the share price would be £1 and the company value would remain at £100. By doing the stock split and reducing the share price down to $400 you are allowing the investor with only $1,500 to buy some shares.

As is obvious splitting shares does not create value. It is the same company, just with more shares.

Except that it does create value. Companies that announce and undertake share splits usually see their valuations increase. It is illogical but there are a whole host of soft justifications including recognising the share price rise that led to the stock split and to signalling management confidence for the future. Whatever the reason that is proposed the effect is clearly visible in the data: companies that announce stock splits are valued more highly after they announce it. Tesla being Tesla outperformed even in this regard. In the absence of any trading or operational news Tesla’s share price rose by 50% over the next ten days.

Conclusion

We do not own any Tesla directly, nor have we bought it for our clients. We believe those that buy this stock at these levels are likely to lose a significant part of their investment. However we believe that this speculative frenzy is likely to persist and may well push the share price wildly higher than it already has. Timing when bubbles pop is in practise impossible – they always go well beyond the levels you think is possible. Our business is in protecting and growing our client’s wealth and owning Tesla stock is inconsistent with these objectives. Buy the car if you like it but don’t buy the stock.

For full transparency we also have no short positions in Tesla, for the following reason….

However……

George Soros coined the term “reflexivity” (in an investment sense). It is the theory that positive feedback loops in an investment can actually lead to substantial and persistent change. In reality having a crazy share price can alter the underlying fundamentals of a business.

In those long forgotten days (April 2020) when Tesla shares were only valued at $500 (or $100 after the split) and the company was valued at a mere $90bn then the company raising money by issuing shares was expensive. Say they wanted to clear their debt and raise another $10bn to fund some of their CAPEX programme – $25bn in all – they would have had to issue probably 30% more shares to do so – a big dilution. With the share price at $2,200 and the company worth more than $400bn, then the dilution is reduced to just 6%. Value has been created by using the inflated stock price as an asset.

Tesla could create even more value with an idea we have discussed in SORBUS: Tesla should buy BMW. In simple terms BMW would add immediate value to Tesla in design, engineering and capacity. Tesla needs to be able to make more cars and there is ample global capacity in what is a declining industry. BMW design and engineering is clearly superior and they would eliminate some of the structural disadvantages Tesla has given itself in areas like chassis design. BMW would have a leap forward in electric powertrains, battery design and software. It is easy to see why such a combination would be attractive and why the synergies would be so value generating.

BMW is worth $40bn today. Tesla’s value increased by $200bn in the ten days after it announced the stock split. If it could persuade the Quandt family (who own a controlling 42.9%) to sell them the company Tesla could pay $60bn, $80bn, even $150bn and the price would be justifiable in terms of the benefits to Tesla.

Inflated share prices are a massive asset if they can be monetised – this is the reflexivity Soros referred to. If we ignore the hype and the share price of Tesla you could construct an argument that Tesla could be worth the same as BMW. It is obviously a fraction of BMW’s size but it has market leading technology etc. If you held your nose you could just about imagine a $40bn fundamental valuation for Tesla. Adding Tesla to BMW (as a straight merger of equals) might lead to say $10bn of value from the synergies discussed which Tesla and BMW owners would share 50/50, so Tesla has created $5bn of value for its shareholders – a good day at the office.

However because of its share price Tesla could buy BMW (for simplicity) for $100bn of Tesla shares, paying a massive premium, valuing it at one quarter of Tesla’s value when the shares are at $2,200. In this example Tesla, that should fundamentally be worth $40bn, has become Tesla/BMW worth $90bn (Tesla $40bn+ BMW $40bn + $10bn of synergies), for the price of 25% of the combined entity. This is instantly adding (for example) a Tesco, or a Vodafone or a Prudential to your company’s value. Silly share prices can be used to add value.

We do not suggest that Tesla is actively considering such a deal or that it is even achievable but we use it to highlight that any objective analysis of valuations must recognise the value that can be generated with an inflated share price.

Absent such deal making Tesla shares remain, in our judgement, hopelessly overvalued as a result of a speculative frenzy from people who are likely to lose their money.

[STOP PRESS – since sending this note for proofing Tesla’s share price has fallen by 22%. It remains hopelessly overvalued.]