A LONG TERM FINANCIAL PARTNERSHIP

Partner led, trusted financial management for active, transparent stewardship of your wealth.

SORBUS clients know what excellence feels like.

Our advice is crisp, clear and decisive. We avoid jargon, ambiguity and imprecision.

↓

WEALTH MANAGEMENT

SOLID PILLARS OF MANAGING WEALTH

SORBUS clients get all of our energy and talent focused on their financial future.

SITUATION ANALYSIS

Gaining a full understanding of your current financial situation and your prioritised goals is essential. It is the solid root structure to your long term financial management. We feel it is hard to overstate the value created when full clarity is achieved.

EVALUATION

Circumstances, information and markets change continuously. Timely and regular reviews of the performance of your implemented plan alongside any revisions to your situation analysis are essential. As with life in general, high levels of care and attention create an environment that encourages solidity and growth.

DESIGN

We take the Situation analysis and design a completely bespoke financial layout that best fits your financial objectives. In time, with a full dialogue with you, a financial plan is completed. Wealth management is not unique here, investing high quality time at the design phase provides long term benefits.

EXECUTION

The financial plan is implemented. Relevant financial structures and accounts are set up and the designed financial plan is taken live.

SITUATION ANALYSIS

Gaining a full understanding of your current financial situation and your prioritised goals is essential. It is the solid root structure to your long term financial management. We feel it is hard to overstate the value created when full clarity is achieved.

DESIGN

We take the Situation analysis and design a completely bespoke financial layout that best fits your financial objectives. In time, with a full dialogue with you, a financial plan is completed. Wealth management is not unique here, investing high quality time at the design phase provides long term benefits.

EXECUTION

The financial plan is implemented. Relevant financial structures and accounts are set up and the designed financial plan is taken live.

EVALUATION

Circumstances, information and markets change continuously. Timely and regular reviews of the performance of your implemented plan alongside any revisions to your situation analysis are essential. As with life in general, high levels of care and attention create an environment that encourages solidity and growth.

↓

INVESTMENT MANAGEMENT

TRUE GROWTH COMES FROM CONTINUAL NURTURE

We believe in an unceasing focus on strategic and tactical asset allocation and investment selection.

Good investment management is the provision of a portfolio whose expected risk adjusted returns best fits the investment objectives and risk appetite of a client.

SORBUS runs discretionary and advisory mandates for the long term.

STRATEGIC ASSET ALLOCATION

What is the ratio of investment in risk asset classes versus low risk asset classes that is most likely to deliver the required investment profile over the long term?

TACTICAL ASSET ALLOCATION

Does the current state of the world suggest a deviation from the Strategic Asset Allocation and, if so, which asset classes and by how much?

INVESTMENT SELECTION

Which portfolio is best placed to deliver the overall performance of each asset class? What balance of direct holding, low cost diversified funds and actively managed funds is suitable? Which individual holdings are preferred, and why?

This investment may fall as well as rise, you may not get back what you put in.

↓

FUND MANAGEMENT

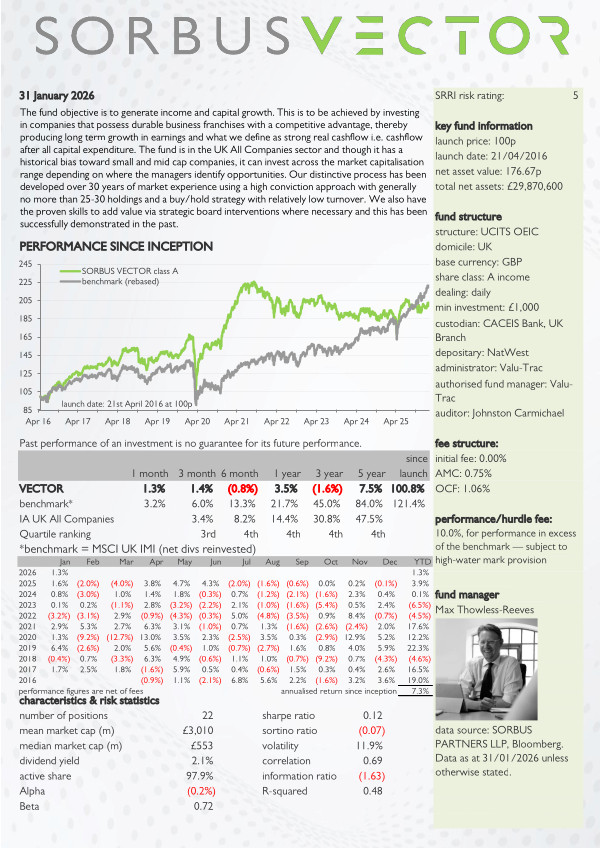

SORBUS VECTOR

A UK All Cap Equity Fund.

A truly active deep value investment fund with a difference.

Investing across the market capitalisation spectrum in UK markets.

“Vector [vec-ter] noun: Possessing both direction and magnitude.”

This investment may fall as well as rise, you may not get back what you put in.

↓

CHARITY MANAGEMENT

SORBUS.org

management and administration of every aspect of your charity

PEOPLE

The key to our success lies in the skill and experience of our people.

Our team has creativity, personality and a deep and broad financial knowledge.

We value transparency above all else.

INSIGHT

IRAN UPDATE

The risks that scare people and the risks that kill people are very different.

The situation in Iran is causing some disruption to financial markets. While this is in its early days and clearly has scope to develop, the lesson of history is that we should not expect any enduring or material impact on financial markets.

SORBUS Spotlight: What is going on with British inflation?

The public hate inflation. That is one reason why between 2022 and 2024 a record number of incumbent governing parties were defeated when facing re-election.

The problem facing both the government, and the Bank of England, is that British inflation remains stubbornly high.

SORBUS Spotlight: The Year Ahead

Setting out firm predictions for the year ahead is always something of a mug’s game. So, instead of making some grand calls for the year ahead, Spotlight will end the year by setting out five big questions for 2026.

MARKET COMMENTARY

Market commentary: 1st October to 31st December 2025

2025 was another good year for investors. Stock markets (with one exception) enjoyed a year of strong growth, and other asset classes also delivered.

Market commentary: 1st July to 30th September 2025

In June 2025 a start-up called Thinking Machines Lab raised $2bn at a $10bn valuation – the largest seed round in history. The company elected not to declare what it was working on.

In 1720 a company was launched “for carrying out an undertaking of great advantage, but nobody to know what it is”.

Market commentary: 1st April to 30th June 2025

Much as an ageing heavyweight boxer loses speed and power after the early rounds, Trump’s war against global trade norms is slowing down.