Negative yields and coronavirus panic

AN UPDATE ON OUR SOVEREIGN DEBT TRADES

Markets have clearly been highly volatile. It has been a long time since the circuit breakers (which halt trading when prices have fallen by a certain %) were used. Equity markets fell sharply yesterday and corporate debt markets were practically untradeable at any volume. There is substantial exposure to oil and commodity companies within corporate debt markets and, as if coronavirus were insufficient entertainment, Saudi Arabia and Russia decided to go “handbags” with each other. The net result is that there will be no cuts in production to meet the declining demand and the price of oil suffered its biggest one day drop since 1991.

As a side note it is worth reflecting on what is and what is not possible to know. Many people have opinions on what will happen to the price of oil in the future but the reality is that the two people who should know more about it than anyone else (Mohammad bin Salman and Vladimir Putin) went into the OPEC meeting expecting a very different outcome than the one that emerged. It will be worth reminding ourselves of this next time an analyst confidently predicts where the price of oil is going.

Our mantra when investing is that it is less about predicting the future and more about being resilient in the face of a dynamic and unpredictable world. The speed and scale of the panic caused by coronavirus caught everyone off guard, but our holdings of cash, sovereign debt and gold gave us ample liquidity and scope to take advantage of market irrationality. We have been busy in this regard, as you will have seen, and the transactions we have undertaken relate to debt as well as equity.

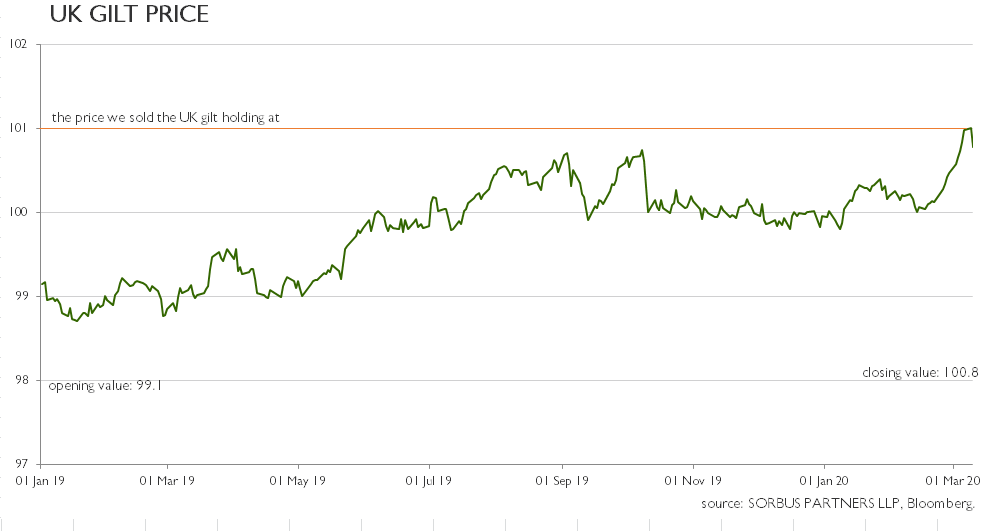

You will recall that for many years we have eschewed junk debt, low grade corporate debt, European and emerging market debt and indeed anything other than relatively short duration UK and US sovereign debt trading below par. This is as cautious and defensive a position we could take in the debt asset class.

Yesterday we sold every sovereign debt holding for our clients. The reason is very simple to articulate: the yields turned negative. The price of these gilts and treasuries had risen to the point where buyers would have a guaranteed loss if they held them to redemption.

The reasons for this sharp price movement are of course strongly connected to the coronavirus spread and the ensuing response of governments, media and people. Is it panic? It feels like it. Certainly the response is disproportionate to the data, but then the data is pretty scruffy and who would rely on official Chinese data anyway? There is a paper to be written down the line about the correlation with government competence and coronavirus responses. Is it any wonder that it is Italy that is the most affected and has felt the need to quarantine the entire country over a mortality rate that is statistically comparable to its road traffic mortality rate? At the opposite end of the spectrum you’ll note how little news we hear from Singapore.

So “safe” assets such as sovereign debt have seen their prices surge as people flee risk assets. There is also a secondary effect in that governmental responses are likely to involve injecting liquidity into the system, lowering interest rates and other activity that is likely to push down yields.

The most recent example of market panic was as a result of the financial crisis in 2008 and there are similarities and differences when compared to today. There are two elements that make us unwilling to extrapolate too much from such a comparison. Firstly the rate of contagion, speed of spread, mortality rate, potential cure etc. make forming a view about the ultimate scale and consequences of coronavirus extraordinarily difficult. It is easy to recognise that the outcome will be bad but when competing “experts” proclaim the inevitability of outcomes which range from “like the flu” at one end and “we’re all going to die” at the other then the main conclusion is that the likely outcome is unknown and unknowable at this stage. Competing with this uncertainty is that the banks and financial systems are significantly more healthy than they were in 2008. Banks (with exceptions like Italy*) are largely robust and will not be the cause of systemic problems this time around.

* Intesa Sanpaolo, rated by some as Italy’s strongest bank, issued debt at a price of 100.0 on February 20th in what we can now see (a whole 12 working days later) was the glory days of Italian banking.

It now trades at 84.00.

There are many reasons as to why yields have fallen below negative. There are also many reasons why yields could continue to fall even further. German bunds have been trading underwater (yields below zero) for years, as has Switzerland and Japan. Indeed if we were compelled to wager if yields would fall lower in the coming weeks we would, on balance, bet that they will. But this is precisely why we have sold. Buying or owning gilts when you are guaranteed to lose money if you hold them to redemption ceases to be investing and has moved decisively into speculation. The buyers or owners today are hoping that factors or demand will drive the price even higher. This is known as the “greater fool” theory: buying today in the hope that a greater fool will buy it from you at a higher price tomorrow. But when the price of an asset becomes detached from any notion of its fundamental value then it ceases to be an investment. To make any money from debt assets with negative yields requires more speculative buying; this is the antonym or opposite of resilience.

There is also a deeper point emerging about asset allocation. Debt investments are categorised as low risk/low return assets and are therefore a natural counterpoint to equities. But risk is a complex and nebulous subject. They have certainly maintained the role of being negatively correlated (when equities fall, debt investments rise) which is one significant positive. Debt investments (at least at the highest quality end) have also maintained their liquidity which is again a positive counterpoint to less liquid or illiquid investments. However, their role as stores of value has ended.

Cash yields virtually nothing and even if there is a nominal yield today we would not expect that to survive the government response to the coming recession – interest rates will be cut. Cash is liquid and neither increasing panic nor emerging calm will increase or decrease its value. It is now a better diversifier in a portfolio than debt investments. The proceeds of the sale of the sovereign debt will be held as cash for the time being, but these are fast markets and we will remain vigilant for protecting your wealth and growing it where we are able. We would be content to maintain these higher cash levels for the time being but when asset prices are so volatile there may be opportunities that emerge in the coming, hours, days or weeks where we can better use the cash in pursuit of your objectives. We will of course keep you informed should such a situation arise.

If you have any questions please feel free to contact us whenever you wish to – we are always happy to discuss our investment approach and believe active communication during times like these is of the utmost importance.