SORBUS spotlight: The Uncertainties in 2025

It is traditional for investment banks, brokers and research houses to put out their year ahead outlooks in December. In general, such documents mostly repeat the consensus and attempt to stand out with a few bold calls. It is equally traditional for many of these bold calls to have proved wrong by the end of January.

Heading into 2025 the consensus looks clear. The analyst community expects 2025 to, in many ways, look rather similar to 2024. As in 2024 the most notable feature of 2025 is expected to be a continuing US macro outperformance, although perhaps by a smaller margin.

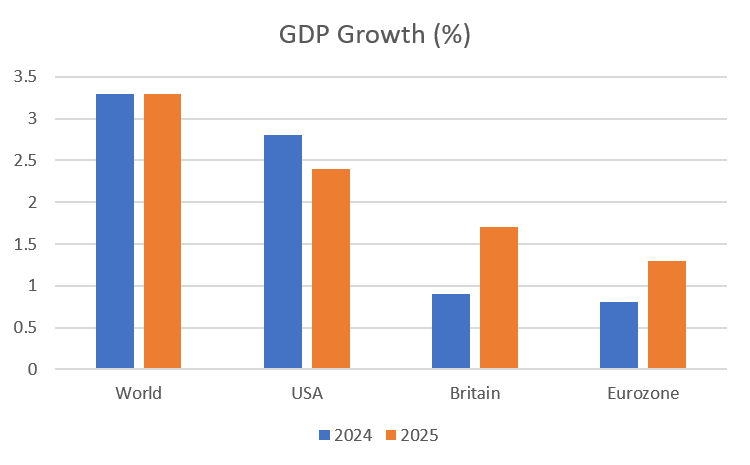

Take, as a representative example, the GDP forecasts of the OECD.

source: SORBUS PARTNERS LLP, OECD (data as at: 17/12/2024)

US growth, in the view of the OECD, will slow somewhat but remain comfortably above that seen even in the accelerating British and European economies.

Of course, the outlook for 2025 is especially uncertain. Donald Trump is, after all, back in the White House and the experience of 2017-2021 suggests that will bring with it higher than normal levels of policy change.

The market reaction so far, the so-called Trump trade, has been to assume that the new President will be able to cut taxes and deregulate whilst the broader fall out from tariffs will be contained. In effect the markets have assumed that the second term will be positive for US equities, bad but not terrible for US bonds and good for the dollar. The consensus view in markets is that US equities, driven by tech, will continue to outperform other national benchmarks.

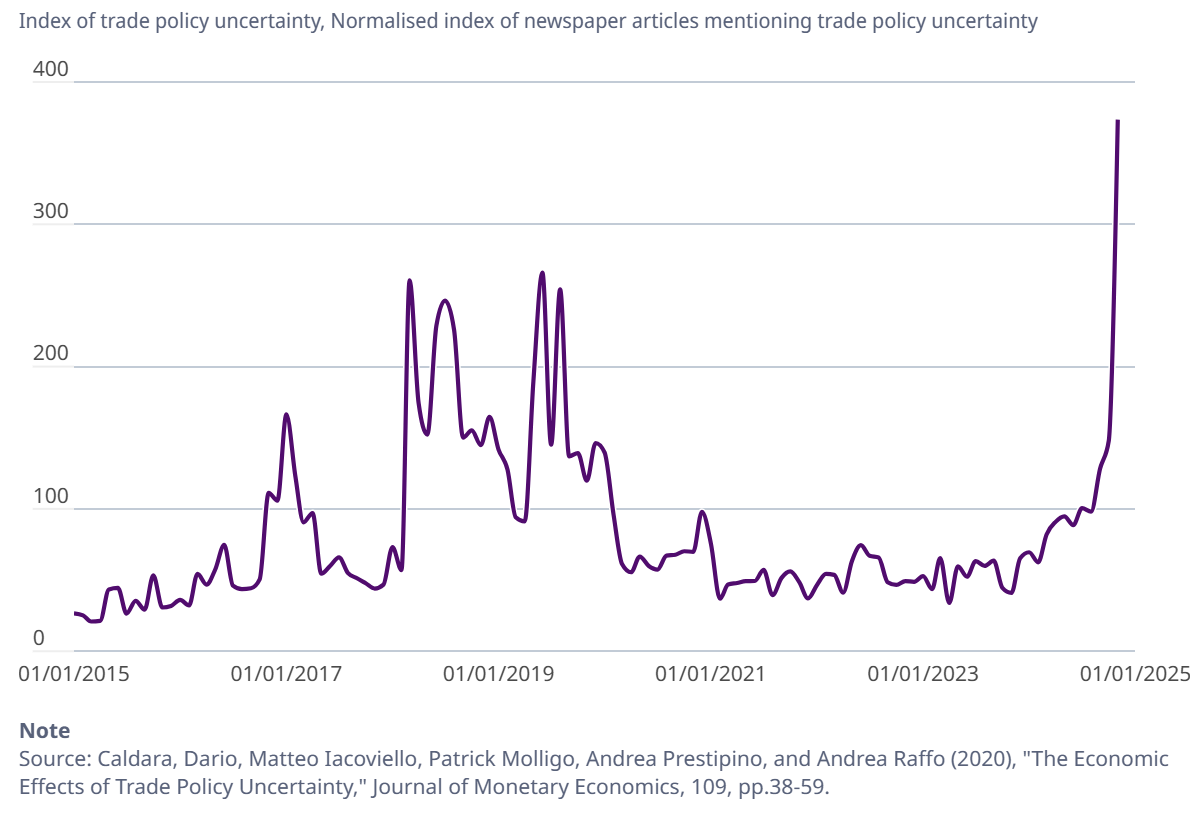

Still, trade uncertainty is high. One measure, compiled by the OECD, uses newspaper references to trade policy uncertainty to construct an index.

By this measure, trade policy uncertainty is higher than even in 2016 after Britain’s vote for Brexit and the first election of Donald Trump.

It is always worth keeping in mind that when it comes to tariffs, Trump’s bark might be worse than his bite. Despite regular threats of 10-40% tariffs to China, Mexico, the EU and Canada, in reality tariff rates during his first term remained low.

source: SORBUS PARTNERS LLP, World Bank (data as at: 17/12/2024)

The chart above shows the average tariff rate charged on all imports over the last two decades. Even when they were raised it tended to be on specific goods (notably steel) and often came with exemptions.

How real the threatened tariff hikes are this time around, is one of the major unknowns heading into 2025.

Nor is trade policy the only major source of uncertainty about 2025, another major unknown is whether or not inflation will continue to fall.

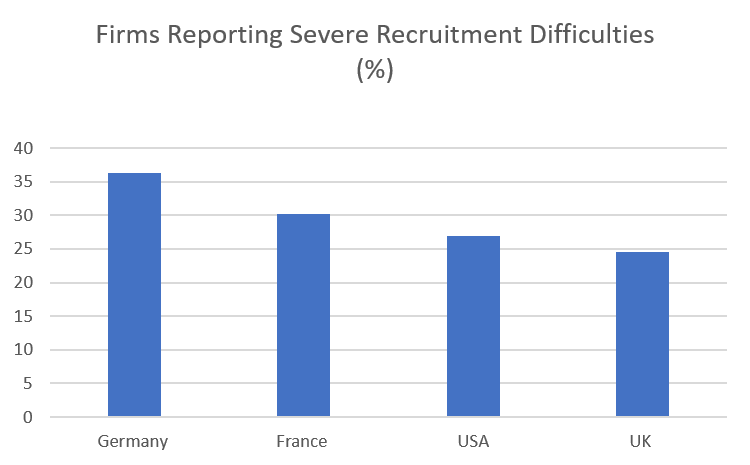

Global jobs markets remain tight with firms across many countries struggling to recruit.

source: SORBUS PARTNERS LLP, OECD (data as at: 17/12/2024)

Aging populations coupled with higher economic inactivity have seen vacancy rates double compared to a decade ago. The result has been rising wage pressure as firms struggle to fill spaces and retain spaces.

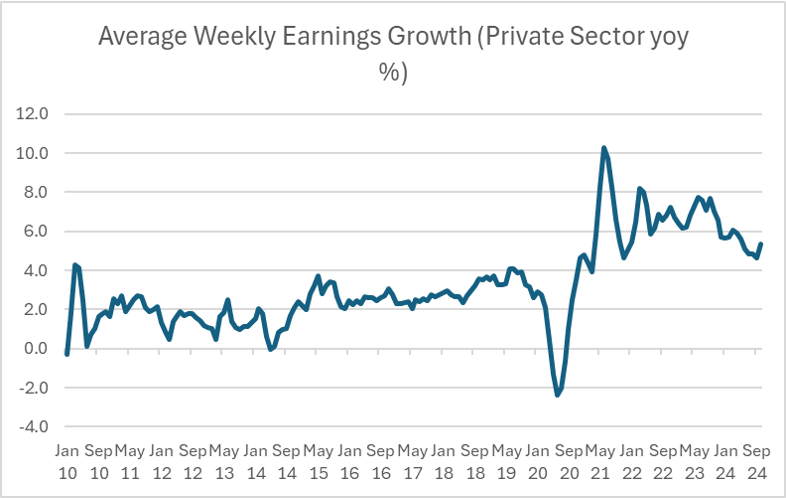

The latest UK data showed a reacceleration in wage growth.

source: SORBUS PARTNERS LLP, ONS (data as at: 17/12/2024)

Private sector wage growth is running above the 5% level which the Bank of England considers compatible with hitting its inflation target in the medium term.

On the other hand, whilst both the USA and the UK contend with inflation which may be too high for comfort, Europe is faced with inflation which may be too low.

The minutes of recent European Central Bank meetings have been filled with concern that inflation may settle well below 2% rather than above it. Too little, not too much, inflation is a problem with which the ECB is familiar. Inflation was below 2% for most of the decade before 2021. With European growth weakening, Germany still in recession and price pressures appearing newly absent, some economists now fear that the ECB mistook a global inflationary surge for a fundamental change in European price dynamics, and raised rates by too much as a result. The most recent survey of professional economists by the ECB points to medium-term euro-zone growth of just 1.3% a year, the lowest since the survey began.

China too continues to struggle with, by emerging market standards, a sluggish rate of expansion and weak price pressures. At the start of December the country’s ruling Politburo stated that monetary policy should be set to a “moderately loose” stance to support growth in 2025. Long term watchers of Chinese macro-policy were quick to note that this was the first time in 14 years that Chinese policy had been officially described as “loose”.

This then is the macro-backdrop to 2025. The world economy continues, as a whole, to expand at roughly the same rate as in 2024. But beneath the surface, there are tensions. The United States continues to grow above trend and may face stubbornly high inflation. Meanwhile both China and the Eurozone face weak growth and inflation which is too low rather than too high. Britain, unfortunately enough, looks set to have inflation which is a touch too high and weaker growth.

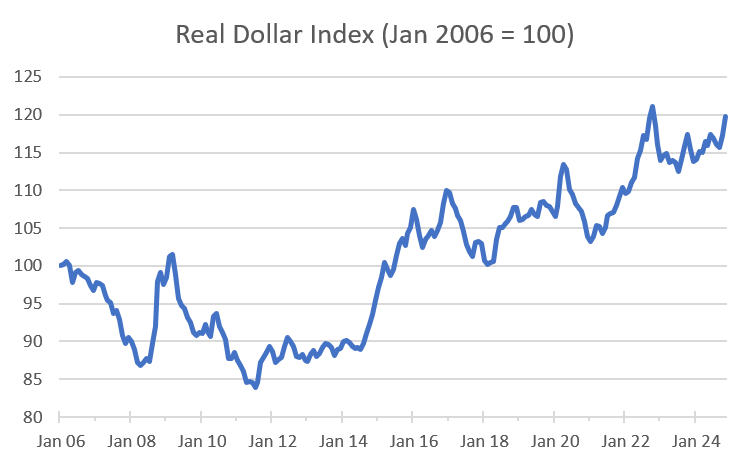

That all leaves the stage set for a divergence in monetary policy in the first half of the year with US interest rates remaining higher whilst Europe and China cut. It is this expected divergence which has sent the dollar higher in recent months.

source: SORBUS PARTNERS LLP, Federal Reserve Economic Data (data as at: 17/12/2024)

Against a broad basket of other currencies, the real value of the dollar (accounting for differing levels of inflation) is up 3.7% in the last 12 months and more than 11% since the beginning of the pandemic. As Spotlight has previously noted, a stronger dollar tends to both depress the level of global trade and tighten financial conditions outside of the United States.

The consensus view of a continuing US outperformance is internally consistent and easy enough to understand. If nothing else, it has the benefit of being familiar, feeling very similar to the recent past. The United States has outgrown all of its developed country peers since 2020, so assuming that this trend will continue is perhaps the path of least resistance.

Whilst the consensus forecasts (see first chart) point to faster American than European growth, they also show the performance gap narrowing this year, however please refer to prior caveat re their accuracy.

What is more, for all the excitement around the Trump trade and the hopes about how a wave of deregulation and tax cuts will boost US performance, the view of most experts is that Trump’s overall policy package, with so much additional policy uncertainty, is likely to hurt rather than help growth in 2025.

However, this fails to incorporate what Adam Smith termed “animal spirits”; the non-economic motivates that shape the activities of entrepreneurs. When choosing to take on more staff there is always an element of measured risk taking. Trump will encourage more to take that risk. As we discussed in a recent trade update:

President Trump’s election represents, we believe, a potentially significant recalibration of the political and economic landscape. Even accepting the sometimes cavernous distance between his words and actions, his manifesto is radical and the clean sweep of both houses of Congress, and winning the popular vote, gives him agency and power.

There are considerable risks in a willingness to part with convention and to be forcefully anti-government and pro-business, and there are global ramifications of major policy changes to tariffs, foreign policy and taxes. Trump is not a long term thinker and this is his second and final term. He will run fast and break things. However, his Presidency will unleash some of the “animal spirits” that drive economic growth. Businesses, investors and markets are likely to thrive, at least for now.

|

What we are watching European PMIs, 2nd January: the PMIs are the most timely indactor of economic growth. The big theme of recent European releases has been divergence. Spain, Greece and other Southern European nations continue to perform well whilst Germany is a laggard. This looks set to continue into 2025. British Retail Sales 9th January: The British Retail Consortium’s December Sales figures are the most important of the year and will give a firm steer on the overall mood of the consumer heading into 2025. Inauguration Day, 20th January: the wait will soon be over. On 20th January Donald Trump will take office for the second time. He has promised a series of day one executive orders on tariffs, regulation and immigration and by the end of his first weekend in office markets should have a clearer idea of how he intends to govern. |