SORBUS Spotlight: The Rally and the Risks

The International Monetary Fund (IMF) publishes two editions of the World Economic Outlook each year (typically in April and October) alongside a couple of smaller scale forecast updates (typically in July and January). As Spotlight has remarked before, these are useful documents. Not because the forecasts are usually right – they are neither better nor worse than the forecasts produced by any other public or private economic forecasters, but rather for two different reasons. Firstly, the four annual forecast rounds, if nothing else, give a set of like for like forecasts – using the same process and team – for the various nations of the world. That provides a useful benchmarking of how growth seems to be faring. But secondly, and arguably more usefully, the semi-annual World Economic Outlook is the best snapshot of global elite opinion amongst policymakers and the best guide to what is currently worrying them and their general mood. The titles alone are useful indicators. The most recent – released last month – being subtitled “Global Economy in Flux, Prospects Remain Dim”. Hardly the most optimistic of choices.

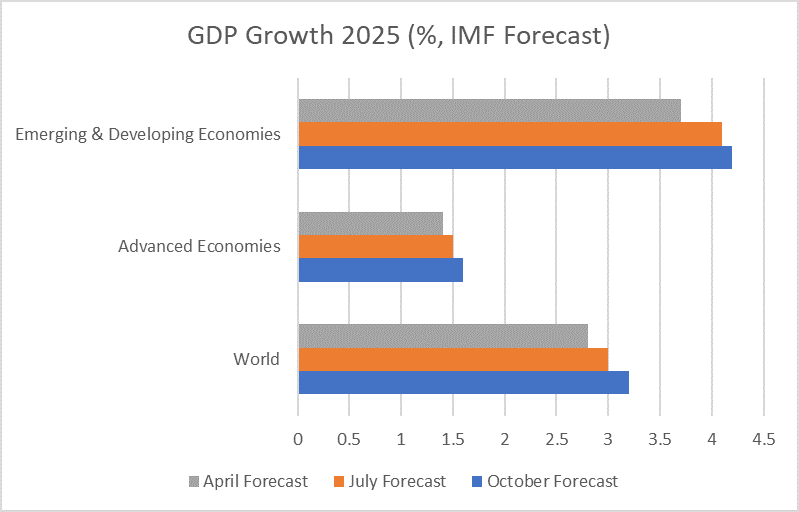

And yet, despite the gloomy title, the numbers underlying the report show an increase in the expected rate of global growth this year. Forecasts were lifted relative to the July update and forecasts had already been boosted in July relative to April.

source: SORBUS PARTNERS LLP, International Monetary Fund (IMF) (data as at: 22/10/25)

Indeed, relative to what the IMF was thinking just six months ago, they now expect world output growth to be around 0.4% higher – a relatively big deal when it comes to the pace of global growth. As the above chart makes clear, that mostly reflects faster expected growth in the emerging economies.

The picture for 2026 is similar, if slightly less dramatic. Growth is expected to be faster than once feared, although the upward revisions are more modest.

As one might expect, much of the opening chapter of the IMF’s latest report is devoted to a form of mea culpa and an attempt to explain why they were too pessimistic back in the Spring.

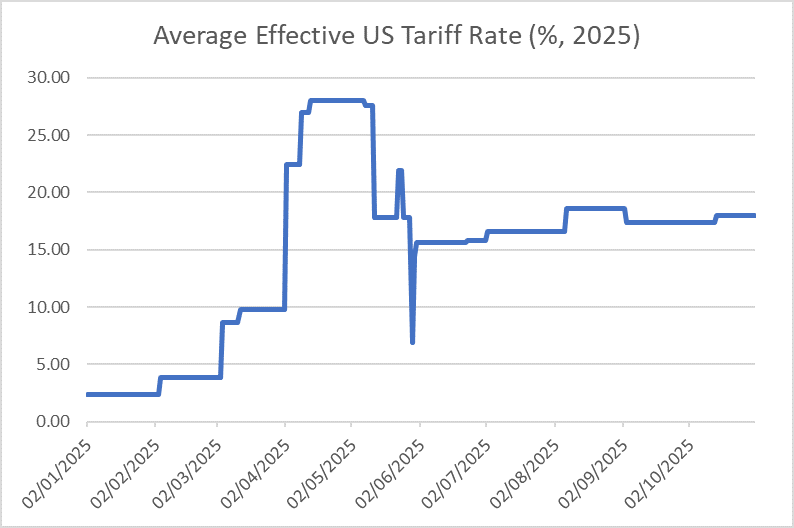

The short version can be summed up in one word: ‘tariffs’. The April forecasts were produced in the immediate aftermath of the Liberation Day Tariffs when tariff rates looked set to be much higher and financial markets were in freefall.

source: SORBUS PARTNERS LLP, Yale University (Budget Lab) (data as at: 22/10/25)

As the second chart makes clear, the average US tariff rate – as weighted by country import shares and the sectoral mix of imports – is materially lower than it was in early April. It is much higher though than it was in January.

That may, or may not, be a fair enough excuse. But either way, it leaves something of a mystery. The IMF has been upgrading forecasts for six months as tariff rates have proved to be lower than once expected and yet the Fund talks about an economy ‘in flux’ and prospects being ‘dim’.

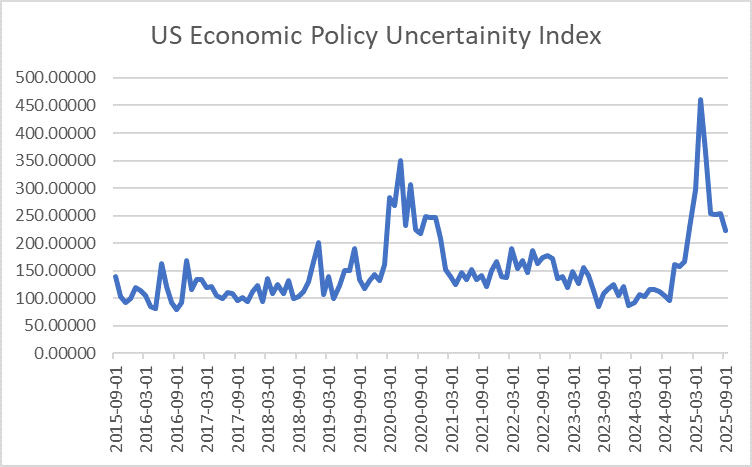

The ‘in flux’ no doubt refers to the continued high level of economic policy uncertainty.

source: SORBUS PARTNERS LLP, Federal Reserve Bank of St Louis (FRED) (data as at: 22/10/25)

The above chart, based on an index of references to policy uncertainty in leading English language newspapers, is not a bad rough proxy. Whilst the index is down from the Spring highs it remains closer to the levels seen in the global pandemic than in normal times. Just this month the President threatened another 100% tariff rate on China on a Friday before pulling back forty-eight hours later.

The real sense one gets reading through the IMF’s latest missive, and the speeches of many of the global policymakers who assembled in Washington to attend the Fund’s annual get together is one of deep unease. With much of that unease stemming from what they see as a disconnect between generally booming financial markets over the last six months and more lacklustre economic performance.

The Bank of England’s Governor expressed similar fears this month. Of course, on the one hand this is what regulators – and to an extent the financial media – do; they point out risks. But it is notable how the very precise language of policymakers has sharpened with recent talk of possible ‘sharp’ downswings and ‘excessively optimistic growth expectations’.

In particular the IMF identified six potential risks, none of which may actually materialise but which, on balance, the Fund believes tilts global prospects towards the downside.

Some of these risks feel more material than others.

Tariffs

Tariff risks come in two categories. The first, and obvious one, is that trade wars may continue to escalate. As seen in President Trump’s recent 48-hour Chinese tariff level roundtrip – and in the continued elevated level of uncertainty – it would be a brave call to claim that trade tensions will now recede.

But there is a second risk here too, it may well be that full effects of already elevated tariff rates have not yet been fully felt. Whilst some firms have chosen to pass on costs on consumers and others to absorb the hit to their margins, many are still muddling through and have yet to make a final decision. Some trade analysts warn that given contract lengths and a reluctance to make major changes in the absence of trade policy certainty, it can take several months for a change in tariff rates to feed through into the real economy.

Labour supply shocks

One of the major sources of inflationary pressure coming out of the pandemic was the hit to labour supply. As immigration temporarily ceased and many workers took early retirement, labour demand outstripped supply and sent wages- and ultimately prices – heading northwards. In comments mostly aimed, at present, at the US the Fund warned that a tough crack down on immigration could have the same sort of impact.

Fiscal policy and credit markets

The IMF was also keen to warn how worries over fiscal sustainability – which are currently acute in France but also increasingly hitting the UK and US – could send the yield on government bonds spiraling upwards with knock-on implications for borrowing costs across the economy.

As Spotlight covered this summer, government debt levels across the rich world are at or near record peace-time levels and annual deficits remain wide in many countries.

Relatedly, the IMF noted the potential for problems in the private credit market – a topic to which Spotlight will return next month – as a potential source of weaker growth. At the very least, a sharp slowdown in lending has the potential to slow capital investment spending and reduce growth.

AI and Markets

Here the usually cautious IMF staff were a bit more explicit than is normal:

Excessively optimistic growth expectations about AI could be revised in light of incoming data from early adopters and could trigger a market correction. Elevated valuations in tech and AI-linked sectors have been fueled by expectations of transformative productivity gains. If these gains fail to materialize, the resulting earnings disappointment could lead to a reassessment of the sustainability of AI-driven valuations and a drop in tech stock prices, with systemic implications. A potential bust of the AI boom could rival the dot-com crash of 2000–01 in severity, especially considering the dominance of a few tech firms in market indices and involvement of less-regulated private credit loans funding much of the industry’s expansion. Such a correction could erode household wealth and dampen consumption. To the extent that the AI hype has led to excessive capital flows into a narrow set of firms and sectors, any unwinding of these positions could then entail a slow economic recovery hampered by capital misallocation.

Perhaps the most important point here is the IMF’s reminder that one does not have to be an AI-sceptic to worry about a potential bubble. The internet – and indeed the railways in the nineteenth century – were major technological breakthroughs that reshaped economies, reordered business models and had very long-lasting impacts. And yet both were also associated with initial bubbles in financial markets which overstretched valuations and led to losses for those who bought at the top.

Commodity price spikes

The IMF also noted that escalation in regional conflicts could drive food or fuel prices higher, once again triggering an inflationary upswing.

The Institutions

Treading lightly, so as not to provoke outrage from President Trump, the IMF warned that ‘Intensification of political pressure on policy institutions safeguarded by a country’s constitution, statutes, and case law—for example, central banks, whose primacy of independence is upheld by both conventional wisdom and empirical evidence—could erode hard-won public confidence in their ability to fulfill their mandates. This could de-anchor the public’s inflation expectations.’

Without being explicit, this is hard to read as anything other than a warning against the current administration’s attempts to gain a greater say in the setting of US monetary policy.

Of course the IMF also identified some potential upside risks – notably a breakthrough in global trade talks or an AI led productivity upswing. But overall it remains pessimistic. As the Fund concluded – ‘to navigate a global economy in flux, policymakers should restore confidence through credible, transparent, and sustainable policies’. Sadly, that does not feel especially likely at present.

|

What we are watching. US data, unknown – It would be nice, given the currently uncertain state of the US economy, to have some hard US data. But until the shutdown ends markets and economists will continue to have to rely on private sector surveys. Global Manufacturing PMIs, November 3rd – This survey based manufacturing data is always a useful leading indicator on the state of global trade and the US numbers, in the possible absence of official data, will be scrutinised especially closely. US Mortgages, November 5th – the Mortgage Bankers Association’s monthly run down on the number of US mortgages extended rarely gets much coverage but, again, in the absence of official data it may provide helpful clues as to the state of the US housing market and general consumer confidence. |