SORBUS spotlight: Is the British gloom overdone?

It is very easy to be gloomy about the British economy. Indeed, Spotlight sounded rather downbeat in the aftermath of March’s budget. But whilst the prospects for the British economy are hardly sparkling, it may be the case that the gloom is now being overdone.

Each month the Treasury publishes a useful round up of independent forecasts by economists working for financial institutions and other organisations. Charting this over time is a useful barometer of confidence in British growth.

The picture for forecasts of growth in 2025 is especially grim.

source: HM Treasury (data as at 15/05/2025)

A year ago the average forecast for growth in 2025 was 1.2%, an historically rather poor performance but slightly up on the 1.1% achieved in 2024. Those forecasts briefly rose to 1.4% in the summer following the general election when it was fleetingly hoped that more stable politics and policy would crowd in foreign investment. By January the expected growth had dipped back down to 1.2% and, over the first four months of this year, that ticked down to just 0.9%.

The case for pessimism is clear: consumer confidence and business confidence remain low – partially as a result of the government talking down the state of the economy for much of late 2024. Taxes are rising, when national insurance contributions prove an especial headache for firms. The global economy has been hit by uncertainty and tariffs for President Trump hitting confidence, delaying investment and raising fears of a global trade war.

But is the gloom perhaps overdone?

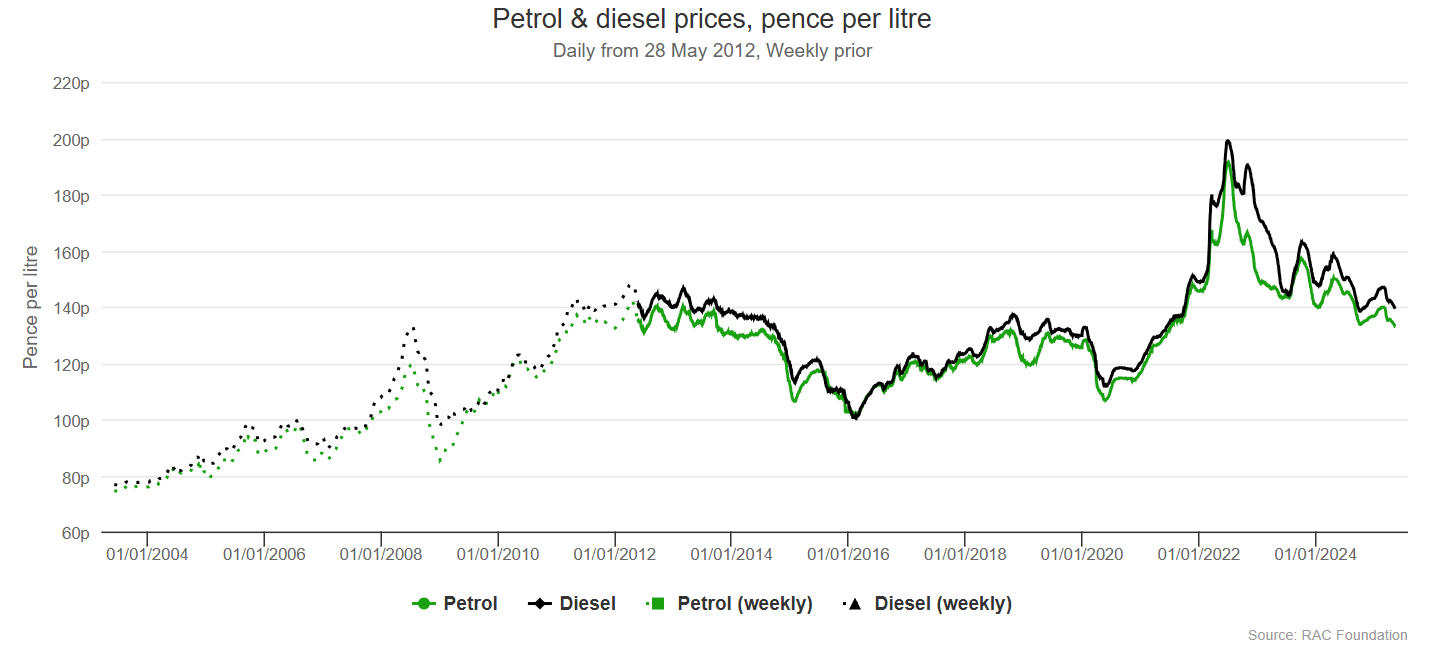

There are at least five reasons to be more optimistic than the current downbeat consensus. The first will be familiar to anyone who has filled up their car recently: petrol prices have fallen sharply.

source: RAC (data as at: 15/05/2025)

The price of unleaded petrol is now around the 130p mark, down from closer to 150p this time last year. OPEC’s decision to expand production, coupled with a weaker outlook for global demand, means this may well fall further in the weeks and months ahead.

That not only adds to household income and helps to keep inflation in check but also is likely to eventually feed through to consumer confidence. Petrol prices tend, over the medium term, to be inversely correlated to British consumer sentiment.

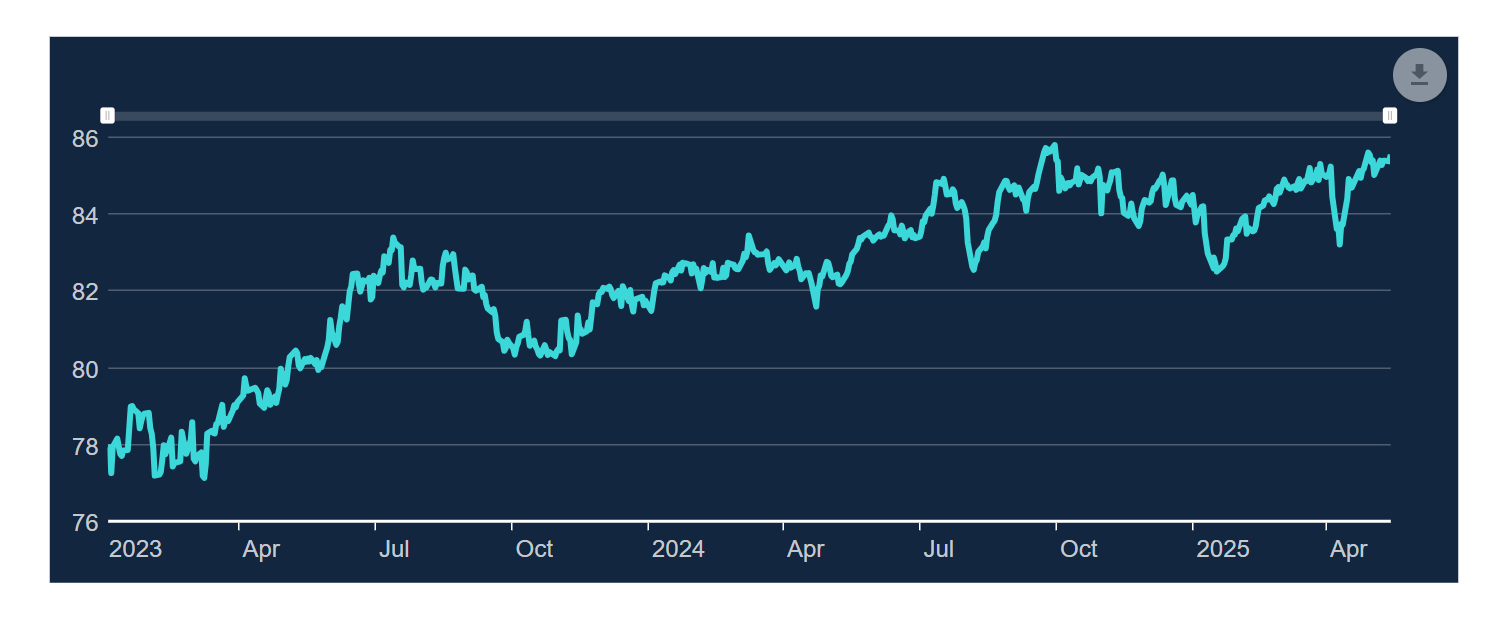

And it’s not just petrol prices where the energy market is lending a helping hand. Natural gas futures are possibly the most bullish indicator for UK consumer prospects.

source: MarketWatch (data as at: 15/05/2025)

The chart above shows the price of natural gas for delivery in December 2025 in the UK. After a worrying spike, which analysts priced into most forecasts of inflation adding to the economic gloom, it has fallen by more than 30% in the last few weeks.

The annual price cap faced by most households has risen for three consecutive quarters but is now expected to fall by an annual £150 in the third quarter of this year. It is currently on track to fall by another £100-150 in the fourth quarter. In other words, the typical household can currently expect to be facing energy bills that are £250-300 lower than at present by the end of the year.

Equally importantly, Sterling has had a strong start to the year – notably against the dollar. The Bank of England’s index of sterling’s value shows it up 1.8% so far this year.

source: Bank of England (data as at: 15/05/2025)

Over the past 12 months it is up by almost 4%.

Whilst not exactly welcome news for British exporters, that does dampen down imported inflation and boost British spending power more generally.

What is more, whilst US tariffs on China have been cut from a ridiculously high 145% to ‘just’ 30% following trade talks in Geneva, that still represents a major change from the old status quo. A substantial proportion of Chinese exports to the United States will not likely be priced out of that market. The net impact in many global markets for various consumer goods – especially electronics – is likely to be an imbalance between supply and demand which pushes down prices further. Some Bank of England officials reckon that the flood of Chinese exports previously bound for the United States and now seeking a new market in the UK could be enough to knock 0.2-0.3 percentage points off annual inflation by the end of the year.

Taken together lower petrol prices, lower energy bills, cheaper imports and potentially cheaper Chinese consumer goods all add up to a package worth perhaps £500-600 annually in extra spending power for the typical household. That should be a useful prop to both consumer confidence and the high street.

It also suggests that the Bank of England may indeed have a bit more room for additional cuts in interest rates in the year ahead.

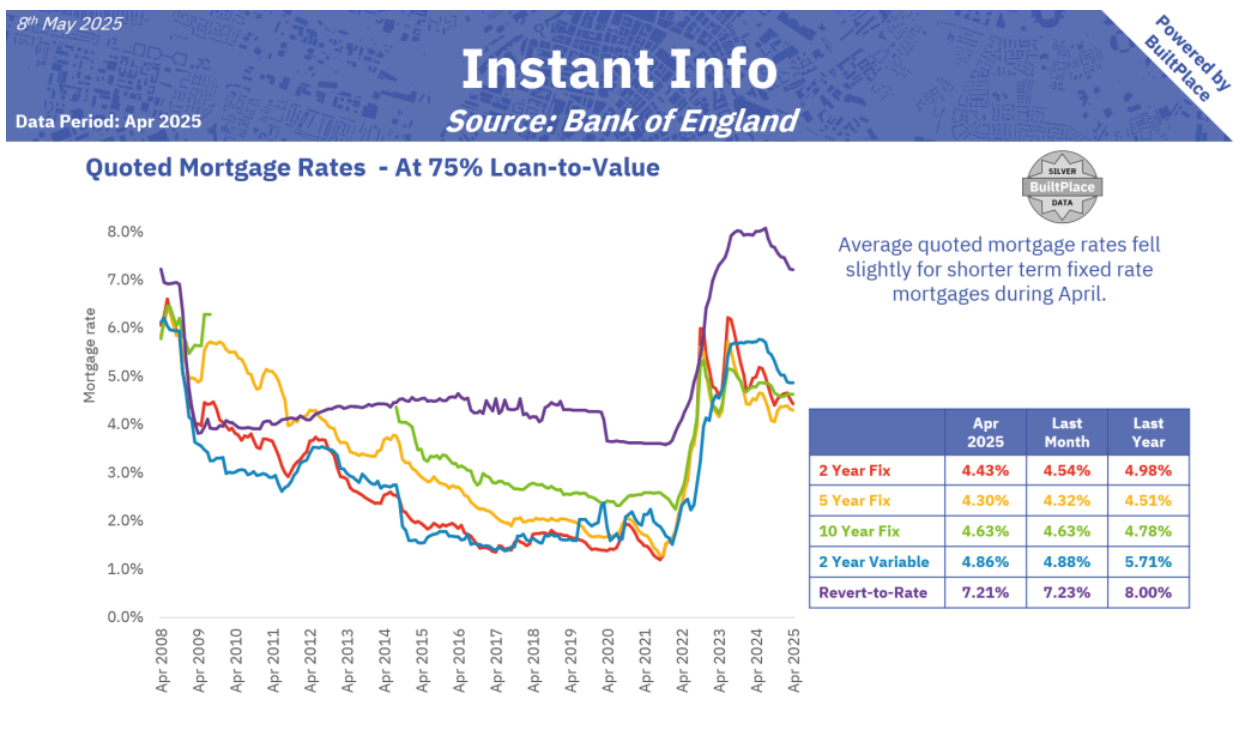

Market pricing has already had a noteworthy impact on the mortgage market.

source: BuiltPlace (data as at: 15/05/2025)

The 2-year fix, still the benchmark UK mortgage rate, has fallen by more than 50 basis points over the past 12 months. With an estimated 65,000 fixed rate mortgages expiring every month in the UK – and with April to June the usual seasonal peak for the housing market – lower borrowing costs are another fillip to household finances and confidence.

Finally there is at least the prospect of faster growth in Germany and the Eurozone as a catalyst for faster growth in the United Kingdom. Germany’s decision to tear up its old fiscal rules and to borrow one trillion euros for defence and infrastructure spending over the coming decade is a major change in German fiscal policy.

Germany, and the Eurozone as a whole, as a major exporter is more exposed to the direct fallout from American tariffs than the UK. And the speed of the deployment of the new fiscal firepower remains uncertain. But, on balance, faster than expected growth in the UK’s largest trading partner is now at least possible. Much will depend on whether or not the European Union is likely to be able to do a deal to avoid the threatened ‘reciprocal’ tariffs from the Trump administration.

Most of the upside potential shocks to the British economy result from global conditions – lower global energy prices, the decisions of OPEC, US tariff policy and German stimulus. But the UK economy is, compared to her G7 peers, an unusually open economy. It is always buffeted by global headwinds and tailwinds. Ever since 2020 it has mostly faced headwinds – notably from energy prices. But, at least in the short to medium term, a tailwind seems to be appearing.

The consensus forecast for growth of just 0.8% in the British economy this year already looks out of date. In February the economy expanded by 0.5%.

In March GDP grew by another 0.2% taking growth over the first quarter as a whole to 0.7%, ahead of market expectations of just 0.6%. That was the fastest quarterly growth in a year and represents an expansion of 1.3% in the year to March.

It feels at present as if most of the potential downside risks have been priced into the forecasts but that potential upside surprises are being left out. No one seriously thinks that a UK boom is on the horizon but at the very least the cycle of downgrades is almost certainly over. More likely still is a gradual process of upgrades over the months ahead. Rather than facing an especially tough year of extremely weak growth it may well be that the UK is capable of eking out another 1.2-1.4% performance, in line with the post financial crisis norm. Whilst that wouldn’t exactly be an excuse for breaking out the bunting it probably would be enough to at least delay the need for the chancellor to embark on further tax rises this Autumn.

Now is not the time for celebration about the British economy but the gloom looks over done.

|

What we are watching. Eurozone Inflation, 3rd June – The ECB has cut interest rates faster than any of her major central peers so far. A debate is now opening up on the governing council as to how much further they need to go. The inflation figures for April will be a crucial clue as to how much lower European borrowing costs can get. Beige Book, 4th June – The Federal Reserve’s Beige Book, imaginatively named after its cover, is one of the best ‘soft data’ indicators available in the United States. It is a round up from interviews conducted with firms across the country by Fed officials. This will be the first such temperature taking since the Liberation Day tariff announcement and should provide timely information on how small to medium sized firms are coping with elevated uncertainty. German industrial production, 6th June – Industrial production is a core indicator of how the German economy is performing. Lower energy prices may finally be feeding through into lower costs and higher production. |