SORBUS spotlight: Third time lucky?

Speaking to a crowd of Western ambassadors at the Polish embassy in Moscow in 1956, the Soviet premier, Nikita Khrushchev, famously declared “we will bury you”. While some paranoid observers took this as a veiled threat to start a Third World War, what Khrushchev was actually talking about was economic output. Stalin’s brutal forced industrialization of the Soviet Union in the 1930s through a series of Five Year Plans, had killed hundreds of thousands and led to huge amounts of human misery but also some of the most rapid growth rates the world had ever seen. In the decade after the Second World War, Soviet growth once again picked up rapidly. As the Soviet leader, it is of course understandable that Khrushchev believed this would continue. More interestingly, though, many observers in the West seemed to have agreed. Paul Samuelson not only won the Nobel Prize in economics, but also wrote the best-selling economics textbook of the 20th century, simply entitled Economics. Beginning in the 1960 edition of that book, he included a graphic showing comparative Soviet and American growth rates and predicted that Soviet output would overtake that of the United States within around 25 years. That graphic was still appearing as late as the 1980 edition, although the point of the takeover still seemed to be some 20 to 25 years in the future. From 1981 onwards, the graphic mysteriously disappeared.

The late 1950s and early 1960s were a period of intense Cold War competition. Amid a backdrop of frantic competition and fears of war, Western analysts were prone to overestimate Soviet capabilities not just in the economic sphere but across the board. This was the era in which US strategists fretted about a so-called “missile gap” which we now know never really existed. It was, though, an undeniable fact that the Soviet economy had been growing at a rapid pace for around three decades, a much faster one than the United States or the capitalist European countries. Projecting that trend forward seemed reasonable enough. Hence all of the talk of crossover which even led astray a Nobel Prize winner. The 1970s were a grim time for Western economies, but an even worse one for the Soviet Union. It was only during that decade that analysts started to realise that the previous high rates of Soviet growth could not be maintained. By the early 1980s, no one seriously expected the Soviet Union to overtake the United States in economic terms.

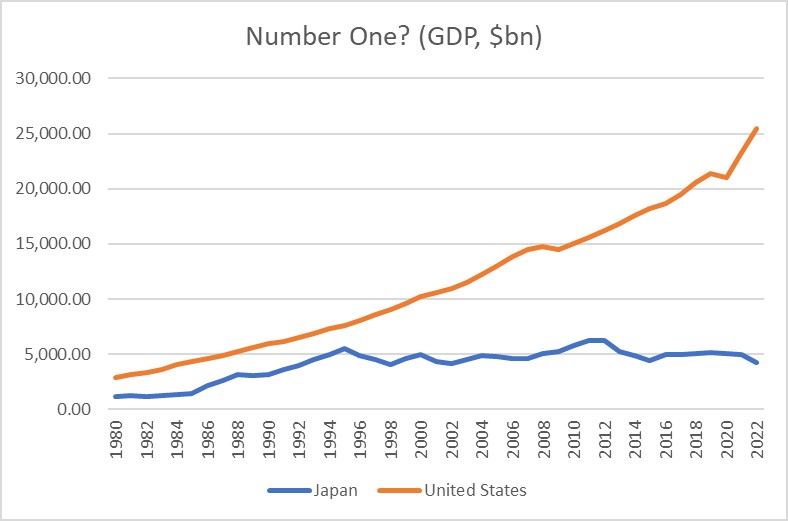

But by the 1980s, there was a new economic threat looming on the horizon. In 1979 Ezra Vogel, a Harvard professor, published Japan Number One. This book looked at Japan’s astonishing growth since the Second World War, argued that it would soon overtake the United States and tried to give American politicians, policy makers and businesspeople some lessons to learn from this staggering Japanese economic success. Over the course of the 1980s, the US economy tended to grow between 2.5% and 3% per annum, Japan was putting in 4% a year plus. With that sort of annual differential, Japan could be expected to overtake the United States economy by the late 1990s or early 2000s. The optimism about Japanese growth prospects left quite a cultural footprint in the 1980s, with many authors and filmmakers looking east for inspiration. It is no coincidence that in 1988’s Diehard detective John Mcclane finds himself battling terrorists in a Japanese owned building – the easiest shorthand to signal a very wealthy corporation that was definitely worth robbing was to make it Japanese.

Sadly for Ezra Vogel and a whole bunch of film makers, such projections never came true.

source: SORBUS PARTNERS, International Monetary Fund, World Economic Outlook Database, April 2023

source: SORBUS PARTNERS, International Monetary Fund, World Economic Outlook Database, April 2023

Much of Japan’s extraordinary growth in the 1950s, 60s and 70s was a result of rapid industrialisation and powerful growth in exports. But by the 1980s, the dominant force was what was clearly, in hindsight, a real estate bubble. Famously, in the 1990, the land under the Emperor’s Palace in Tokyo was allegedly valued at more than the entire state of California. Like all such bubbles in history, that one eventually popped. The result was a Japanese banking crisis which it took the country almost two decades to recover from. No one talks any longer about Japan being number one.

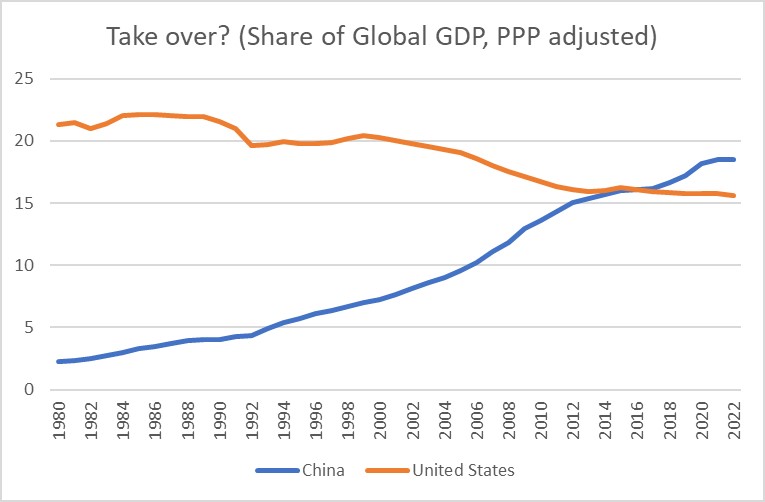

Instead, following the failure of the Soviet and Japanese challenges to American economic hegemony, there is a new kid on the block. Over the past 15 to 20 years, the focus has firmly been on China. That focus on China is entirely unsurprising. Chinese growth since around the early 1980s has been at an even more astonishingly rapid pace than that witnessed by the Soviet Union or Japan before it. Indeed, according to a measure favoured by many economists, including the International Monetary Fund, the question of when China will overtake the United States in terms of global economic weight has already been answered. It happened almost a decade ago.

source: SORBUS PARTNERS, International Monetary Fund, World Economic Outlook Database, April 2023

source: SORBUS PARTNERS, International Monetary Fund, World Economic Outlook Database, April 2023

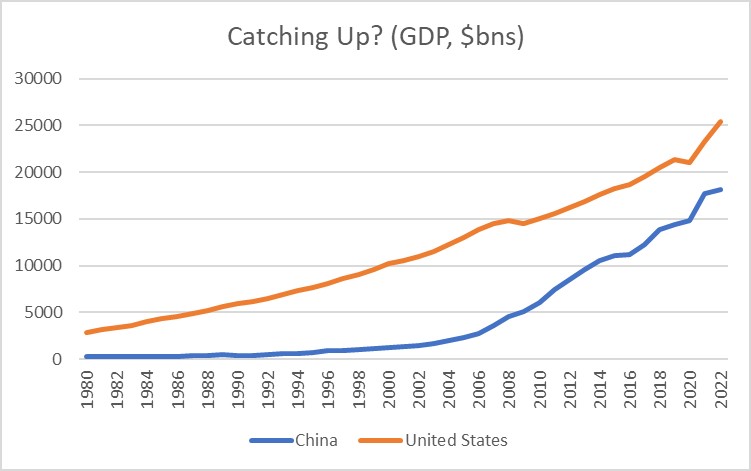

The chart above shows the economies of the United States and China as a percentage of the global total. But crucially, it employs a technique known as purchasing power parity adjustment. PPP is a way to compare economies over time or over vastly different geographies. It attempts to minimise the impact of exchange rate variations by accounting for differing price levels in countries. This is a sensible approach, but it only tells us so much. Whilst there is no doubt that China’s economy has experienced spectacular growth since the 1980s, is it really now larger than that of the United States? Sometimes a simple approach is better. Forgetting about fancy adjustments for price levels, just comparing the size of China and the United States economies in dollar terms tells a slightly different story.

source: SORBUS PARTNERS, International Monetary Fund, World Economic Outlook Database, April 2023

source: SORBUS PARTNERS, International Monetary Fund, World Economic Outlook Database, April 2023

The story is still one of incredibly fast Chinese growth. In dollar terms, China’s economy at the turn of the millennium was worth around 10% of that of the United States. A decade later, in 2010, it was worth around 40% of that of the United States. Fast forward another decade and, as the pandemic hit, China’s raw GDP was perhaps 70% of the size of American GDP. Another decade like that, and China’s economy would certainly overtake that of the United States in both raw dollar terms and purchasing power adjusted ones. But will China have another decade like that? The glide path looking at the most recent data points on the chart will note that the line seems to be going in the wrong direction.

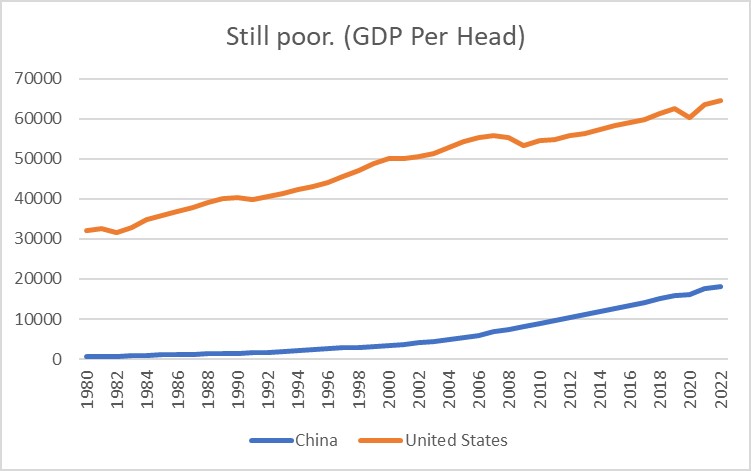

One reason to believe that China’s economy will eventually overtake that of the current leader is the simple fact that there are an awful lot of Chinese people. A look at GDP per capita. Tells an interesting tale.

source: SORBUS PARTNERS, International Monetary Fund, World Economic Outlook Database, April 2023

source: SORBUS PARTNERS, International Monetary Fund, World Economic Outlook Database, April 2023

It can be quite easy to forget what a staggeringly poor country China was back in 1980. Income per head at the start of that decade was only around 2% of American levels. But even after four decades of rapid economic growth, China is still a poor country. Income per head is less than 1/3 of US levels. This is a crucial point, Chinese income per head does not have to rise that much higher for overall Chinese income to outpace that of the United States. Even with the differing population levels, if China could get its income per head to perhaps 40% of American levels, then whilst individual Chinese people would still be much worse off than their American peers, the Chinese economy would be larger in dollar terms than that of the United States. Given that Chinese GDP per capita has risen from 2% of US levels to 30% over the past 40 odd years, surely a rise to 40% seems plausible? Perhaps. But then Soviet economic growth, continuing at the same pace into the 1970s and 1980s, seemed very plausible in the 1960s. Japanese economic growth, continuing at the same pace seen in the 1960s, seventies and 80s into the 1990s and 2000s, seemed plausible not too long ago. Simply assuming that a trend will continue forever is hardly the most robust manner of analysis. Listening to the most enthusiastic China-boosters sometimes calls to mind a character in a flashback scene in The Simpsons (Disco Stu) who notes that sales of disco records rose by 400% from 1970 to 1975 and assumes that will continue. And even if such mechanical projections were to be accurate, it assumes that China’s population will remain so much larger than that of the United States. This is far from clear.

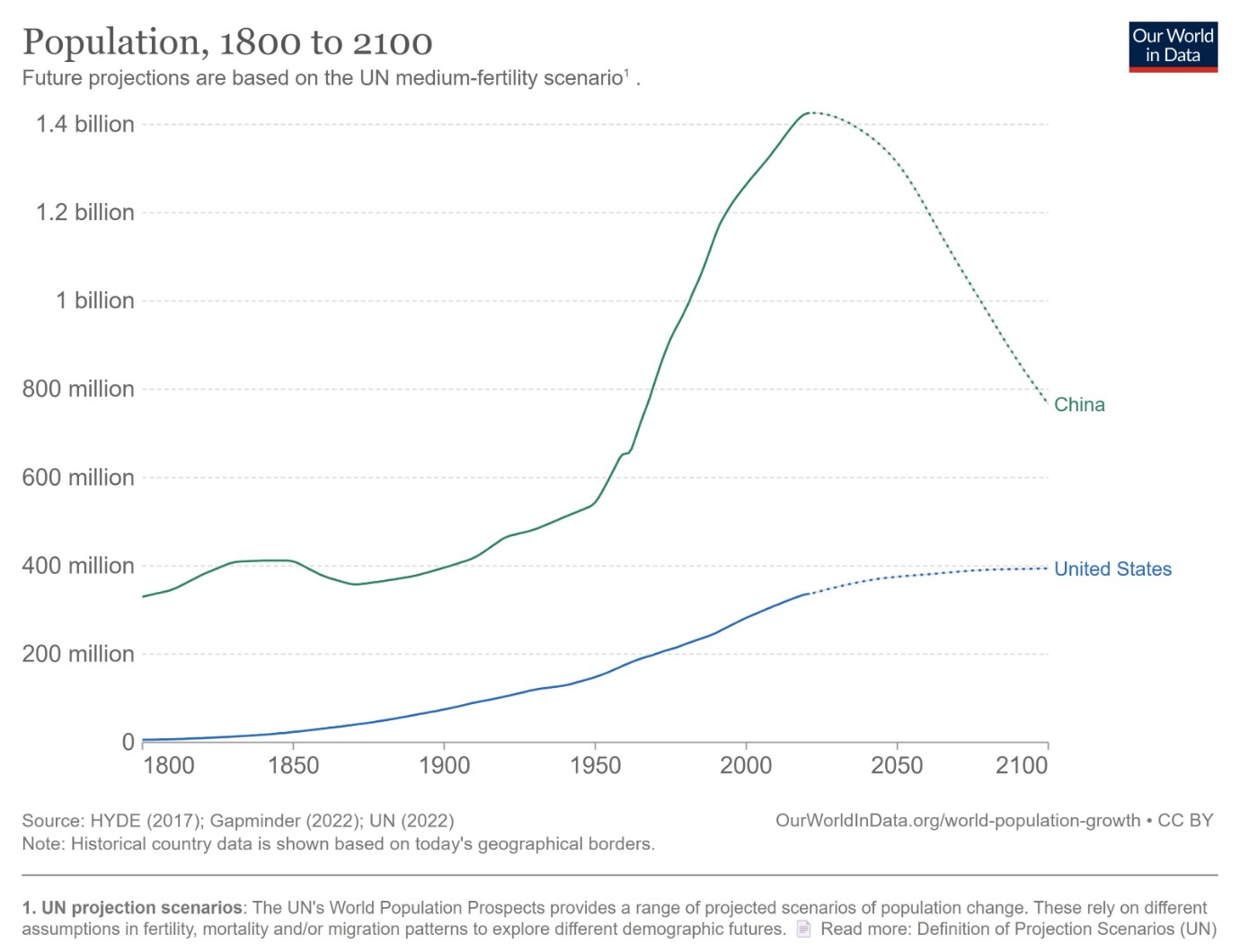

The fear that China will grow old before it grows rich is one that has dogged Chinese policy makers for the last two decades. China’s demographic picture is incredibly poor. The one child policy of the 1980s and the 1990s have led to a shortage of young people. Whilst rising living standards and improved healthcare have led to a rising share of the population being older. UN population projections, shown in the chart above, are roughly in line with consensus. Most analysts believe that China’s population has already peaked and will fall quite substantially in the decades ahead. The US, by contrast, enjoys a higher birth rate and more inward immigration. If by 2100 there are indeed 400 million Americans and fewer than 800 million Chinese citizens, then Chinese GDP per head would have to rise to 50% of US levels for China’s economy to overtake that of America. That, it should be remembered, is approximately a doubling of the current level.

If economies always did develop in line with previous trends, then economic forecasts would generally be accurate, rather than as they are, rarely correct.

Right now, China’s economy is in a mess. Its real estate bubble is not as large as Japan in the late 1980s, but still one of the biggest in history. The government is struggling to contain the fallout on the banking system and the finances of the local government. Chinese economic data always needs to be taken with a pinch of salt. But things are clearly bad when the government has decided to cease publishing youth unemployment statistics. According to the most recent numbers, retail sales in China, excluding petroleum and petroleum products, grew at less than 3% in the last year, in real terms. By contrast, retail sales, excluding gasoline stations in the US, are rising at an annual pace of 7%. Retail sales, of course, are not the whole economy. But there is plenty of evidence out there pointing out that the United States may currently be growing at a faster pace than China.

60 odd years ago, it was a near consensus position in the Economic Community, and indeed amongst many investors, that within a few decades the Soviet Union would overtake the United States. 35 or so years ago, it was a near consensus that Japan would overtake the United States eventually. Both of these arguments could draw on previous trends going back decades. Neither turned out to be correct. For much of the past 20 years, the notion that China will eventually overtake the United States has also become a near consensus. Growth rates have been spectacular and the population is so much larger. Maybe it will be a case of third time lucky. But nothing in global economics is ever as clear cut as it seems.

|

WHAT WE ARE WATCHING 24-26th August, Jackson Hole: Once a year the US Federal Reserve holds a symposium for global monetary policy makers and academics in the countryside of Wyoming. Aside from enjoying time on a ranch and a bit of horse riding, it is an opportunity for Fed board members to signal their policy and concerns over the coming year. 6th September, BOE in Parliament: The Bank’s Governor and Chief Economist appear before the Treasury Select Committee several times a year. Usually it is an occasion for a bit of grandstanding by MPs and not much new information. But with the Bank under pressure over previous forecast failings and promising a new system, this appearance will be worth watching to find out how the Bank intends to revise its approach in the future. 11th September, Chinese inflation: China may have stopped publishing youth unemployment data but it is trickier to stop publishing inflation numbers. On a year on year basis, prices fell by 0.3% in August. And whilst falling prices might sound like a welcome relief to Western consumers hit by a cost of living crisis. A falling price level rarely is a healthy sign for an economy overall. If the deflation has intensified further then it will be a further sign of Chinese economic distress. |